Colorado Business Brokers

We are very different than other business brokers. Check us out. Our President is Glen Cooper. His personal cell phone is 303-919-2694. Call him now for a free, no-obligation confidential consultation about your business. Leave a message if you don’t reach him.

We are very different than other business brokers. Check us out. Our President is Glen Cooper. His personal cell phone is 303-919-2694. Call him now for a free, no-obligation confidential consultation about your business. Leave a message if you don’t reach him.

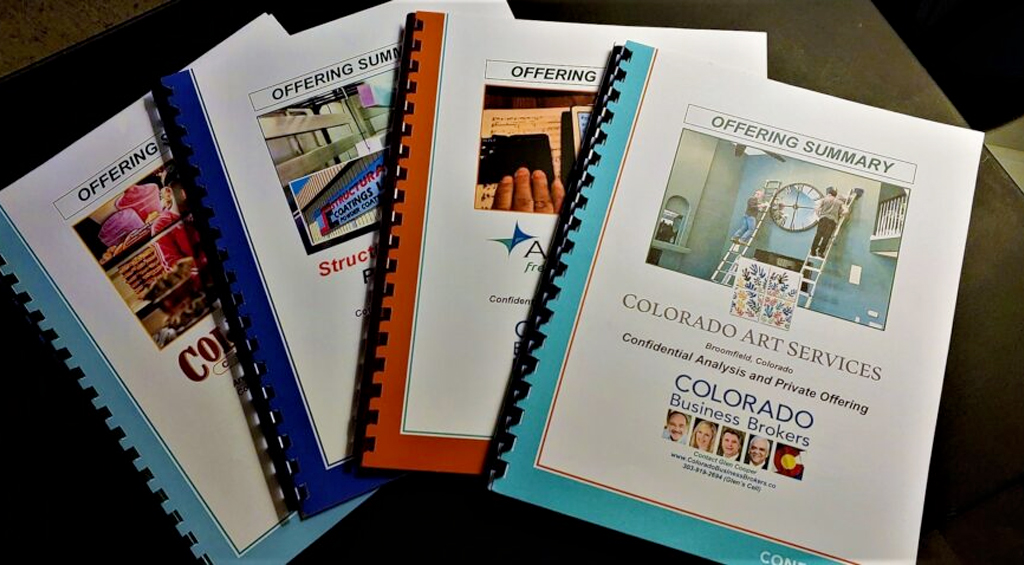

What we do differently is our level of professional “packaging” and our in-depth teamwork with our seller clients. Our “Offering Summaries,” the presentations we create for the businesses we offer, are widely known as “the best” in our profession. We also recognize that every seller needs to be served by more than just one broker. We are fiduciaries for seller clients.

We sell small businesses, but that can be up to 500 employees and as large as $50MM in sales, or a small as 5 employees and just $1MM in sales. The key variable for us is our preference for dealing with founders and owner/operators.

We’d rather spend our time working with entrepreneurs who want to sell to other entrepreneurs. We’d rather not work with cadres of professional advisors and investors who are “rolling up” industries for resale.

Our “home turf” is Denver, Colorado. About 3.5 million people live here. 95% of the state’s businesses are here. This “Front Range” market is the center of our state. It’s also a major regional center.

Contact us today to find out what we can do for you!

Selling a Business

We produce “world class” marketing materials for business owners who hire us to sell their businesses. Let us show you what sets us apart.

Buying a Business

Prospective business buyers can expect a complete package of information on each business opportunity we represent. Check us out at www.BizBuySell.com.

Who We Are

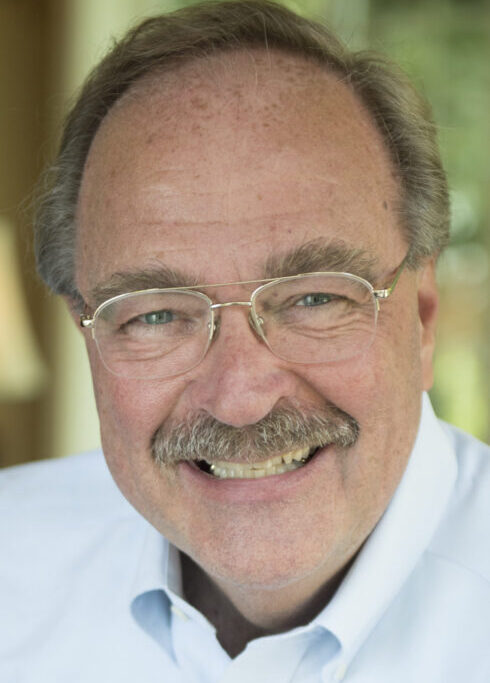

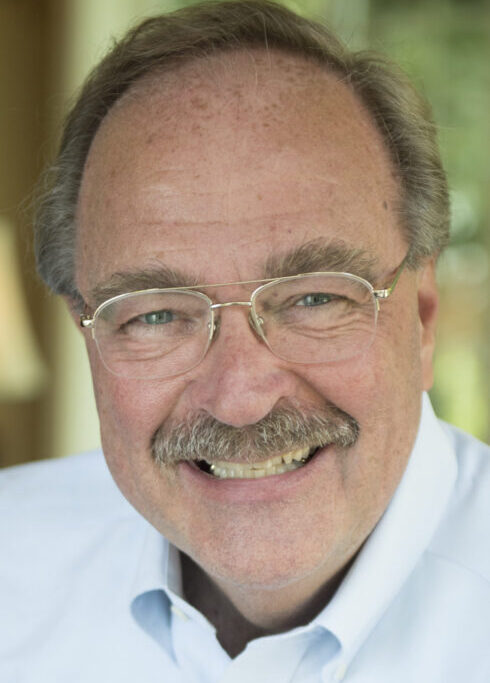

Glen Cooper

Business Broker

Glen Cooper is the founder and president of Colorado Business Brokers. He has been a business broker since 1979, was a credentialed business appraiser for 26 years and has been a business coach for small business owners since 2008.

Michelle Regner

Business Broker

Michelle Regner has been the founder and CEO of three SaaS technology companies that she grew and then sold. She is now President and owner of Business Brokers of Utah and has entered into a strategic partnership with Colorado Business Brokers…

Matt Mulcahy

Director of Operations

Matt Mulcahy is the Director of Operations for Colorado Business Brokers. He has a background in business management, operations, sales, and marketing.

Amy Kinser

Business Broker

Amy Kinser sold her business, in Eagle County, Colorado, in March 2022. Before buying that business, she had a 30-year career as a human resources director, benefits administrator, payroll and accounting manager…

Ramon Sanchez-Vinas

Business Broker

Ramon Sanchez-Vinas is a business executive with over forty years in executive management and sales in both the public and private sectors. He is also a serial entrepreneur who has owned and operated several…

Glen Cooper

Business Broker / Business Coach

Glen Cooper is the founder and managing partner of Colorado Business Brokers. He has been a business broker since 1979, was a credentialed business appraiser for 26 years and has been a business coach for over 15 years.

Michelle Regner

Business Broker / Business Coach

Michelle Regner has been the founder and CEO of three SaaS technology companies that she grew and then sold. She is now President and owner of Business Brokers of Utah and has entered into a strategic partnership with Colorado Business Brokers…

Matt Mulcahy

Director of Operations

Matt Mulcahy is the Director of Operations for Colorado Business Brokers. He has a background in business management, operations, sales, and marketing.

Amy Kinser

Business Broker / Business Coach

Amy Kinser sold her business, in Eagle County, Colorado, in March 2022. Before buying that business, she had a 30-year career as a human resources director, benefits administrator, payroll and accounting manager…

Ramon Sanchez-Vinas

Business Broker

Ramon Sanchez-Vinas is a business executive with over forty years in executive management and sales in both the public and private sectors. He is also a serial entrepreneur who has owned and operated several…

Latest News and Updates

All the latest news on Selling and Buying Business. Browse the complete collection of articles.